New study finds that average revenue per user increases by up to 16% in countries that implement Mobile Number Portability policies

Singapore, 30 August 2022—Switching telecommunication providers need not be a chore for customers. A new study found that when telcos lower switching costs, such as by letting customers retain their numbers when changing service providers, both customers and telcos benefit.

The study was jointly conducted by Visiting Assistant Professor Niloofar Abolfathi and Assistant Professor Simone Santamaria, both from the Department of Strategy and Policy at the National University of Singapore (NUS) Business School, and Professor Andrea Fosfuri from Italy’s Bocconi University. They published their findings in the Strategic Management Journal earlier this year.

How the study was done

In the late 1990s, countries around the world started implementing number portability policies that enabled consumers to switch their service providers while keeping their contact numbers. This was in the hope of increasing industry competition and reducing prices. Singapore, for instance, introduced the policy in 1997.

Analysing data on 563 telcos across 178 countries from 2000 to 2017, the research team examined how the firms’ pricing strategies and profits had changed in the aftermath of the number portability policy. Out of 563 operators, 337 had experienced the policy.

“The conventional wisdom among telecommunications managers at that time was that trapping customers through high switching costs was very profitable for companies and, for this reason, several of them opposed the introduction of portability policies. However, the data pointed to a different outcome. Surprisingly, the number portability policy led to an increase in prices and firm profitability in the long run. For customers, number portability allowed them the convenience of retaining their numbers and, though they paid more for premium plans, they enjoyed better value as service providers became more competitive in that space,” said Visiting Asst Prof Abolfathi.

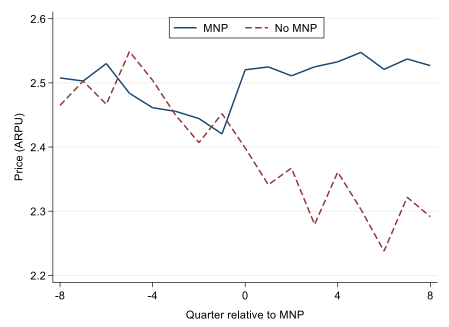

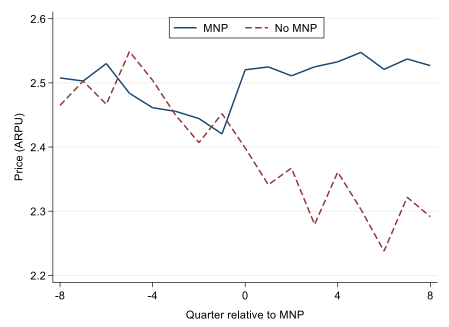

The average revenue per user increased by up to 16 per cent in countries that implemented the policy.

The blue graph shows that the average revenue per user (ARPU) (logged) increased after the mobile number portability (MNP) policy was introduced. This is in contrast to countries that never implemented or have yet to implement MNP (the red graph). The x-axis refers to quarters relative to MNP adoption as firms adopt MNP in different years and quarters.

The key explanation is a change in the business model of telcos in the aftermath of portability policies.

Before number portability, in the presence of significant customer switching costs, firms develop business models that resemble funnels, designed to convert customers of a basic and inexpensive version—prepaid services—into adopters of an advanced and more profitable version—postpaid services. However, because firms anticipate the margins they can make on captive customers buying the advanced version, they enter into a mutually destructive price battle for the basic version.

This business model has negative effects on the profitability of companies when widely adopted as it forces all competition into the narrow and less differentiated space of the basic-version market, making firms unable to exploit their superior differentiation in the advanced-version market.

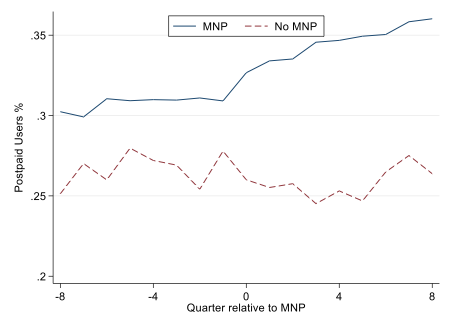

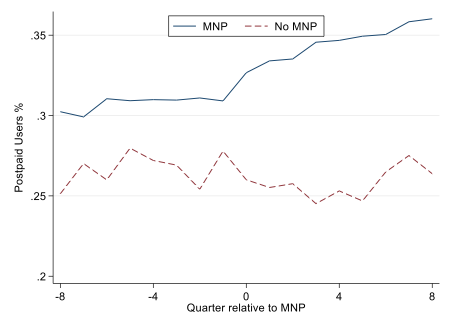

When customer switching costs are lowered, there is an increase of about 13 per cent of customers who move to the more expensive postpaid version, resulting in greater profitability for firms. This is because customers are willing to sign longer-term contracts and choose more advanced or “premium” plans, knowing they can switch providers without penalty when they want to. This shifts the competition into the more advanced segment and incentivises service providers to offer more value and differentiated propositions in this segment.

Firms that experienced the MNP policy (blue graph) saw an increase in the proportion of postpaid subscribers after the MNP policy was implemented. This is in contrast to firms that did not experience the policy (red graph).

Assistant Professor Santamaria said, “Our paper suggests that strategies aimed at enhancing firm profitability exclusively through creating and maintaining customer frictions like high switching costs are generally not very effective in the face of competition. Indeed, customer frictions generate several unexpected side effects on firms’ profitability. The findings can likely extend beyond the telco industry to other industries that commonly see the conversion funnel business model, such as industries for software, mobile apps, cable TV and cars, as well as in developing countries.”

The researchers will next look at how the business models of companies interact with market frictions in different contexts and industries.

For media enquiries, please contact:

ANG Hui Min

Senior Manager, Corporate Communications

NUS Business School

National University of Singapore

Tel: +65 6601 5857

Email: huimin19@nus.edu.sg

About National University of Singapore (NUS)

The National University of Singapore (NUS) is Singapore’s flagship university, which offers a global approach to education, research and entrepreneurship, with a focus on Asian perspectives and expertise. We have 16 colleges, faculties and schools across three campuses in Singapore, with more than 40,000 students from 100 countries enriching our vibrant and diverse campus community. We have also established our NUS Overseas Colleges programme in more than 15 cities around the world.

Our multidisciplinary and real-world approach to education, research and entrepreneurship enables us to work closely with industry, governments and academia to address crucial and complex issues relevant to Asia and the world. Researchers in our faculties, 30 university-level research institutes, research centres of excellence and corporate labs focus on themes that include energy; environmental and urban sustainability; treatment and prevention of diseases; active ageing; advanced materials; risk management and resilience of financial systems; Asian studies; and Smart Nation capabilities such as artificial intelligence, data science, operations research and cybersecurity.

For more information on NUS, please visit www.nus.edu.sg.

About NUS Business School

The National University of Singapore (NUS) Business School is known for providing management thought leadership from an Asian perspective, enabling its students and corporate partners to leverage global knowledge and Asian insights.

The school has consistently received top rankings in the Asia-Pacific region by independent publications and agencies, such as The Financial Times, Economist Intelligence Unit, and QS Top MBA, in recognition of the quality of its programmes, faculty research and graduates.

The school is accredited by AACSB International (Association to Advance Collegiate Schools of Business) and EQUIS (European Quality Improvement System), endorsements that the school has met the highest standards for business education. The school is also a member of the GMA (Graduate Management Admission) Council, Executive MBA Council, Partnership in Management (PIM) and CEMS (Community of European Management Schools).

For more information, please visit bschool.nus.edu.sg, or go to the BIZBeat portal, which showcases the School’s research.