Even amidst the COVID-19 pandemic crisis, listed companies in Singapore are experiencing a transition on the corporate governance front. With the revised Code of Corporate Governance expected to come fully into effect by this year, companies have been aligning their practices to the new Code.

Continuing the upwards trend of past years, SGTI 2020 has once again reached an all-time high mean overall score of 67.9 points – a solid 8.6 points increase over the previous year (Figure 1). Comparing to the previous year, the mean base scores and bonus points have risen by 3.2 and 3.0 points respectively, while the number of penalty points taken have dropped by 2.4 points. These results are commendable and point towards an improving corporate governance landscape.

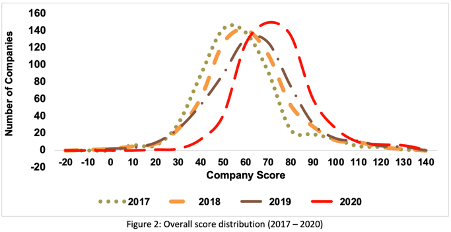

The increase in mean score is evident in the score distribution over the past few years (Figure 2), where a noticeable shift to the right can be observed. In addition, the peak of the distribution is taller this year, indicating that more companies are achieving this higher mean score compared to previous years.

Observable Effects

Alongside the commendable progress, the results of SGTI 2020 have provided several insightful observations.

(1) Closing-Up Effect

Notably, a “closing-up” effect has been observed. Companies that did not do as well last year tended to register greater improvements in overall score compared to companies which did well. This effect is reflected in the score distribution (Figure 2). While the distribution has become narrower, the distribution has also shifted noticeably towards the right with a higher peak. This indicates that a lot more companies are scoring in the 65 to 85-point range, as opposed to the 55 to 70-point range the year before.

In fact, the top 20 companies in SGTI 2019 registered an average 3.1 points improvement this year, while the companies in the 301th to 450th place and those above 450th place registered a much larger improvement at 8.3 and 20.5 points respectively. This implies that the lower-ranked companies are improving much more than the top companies.

(2) Size Effect

A further analysis of the scores revealed a positive correlation between a company’s score and its market capitalisation, suggesting a size effect. In fact, the mean score for large-capitalisation companies stood at 91.5 points, compared to 78.1 and 64.6 points for medium and small-capitalisation companies respectively. Interestingly, the increase in scores tends to flatten with an increase in market capitalisation. This indicates that companies with larger market capitalisation tended to experience smaller increases in score, which further corroborates the “closing-up” effect.

(3) Industry Effect

While there was no apparent relationship observed between a company’s industry and its score, it was observed that companies in the communication services and financial industries performed slightly better (Figure 3). This is seen in a box-and-whisker plot which shows the spread of scores and interquartile range as well as the mean and median values within each industry.

Risk Management

As companies continue their long battle against the pandemic crisis, it is an apt time to pose this question: Are the corporate governance structures in companies sufficient to combat these so-called “black swan” events when or even before they occur?

As it turns out, the risk disclosures of companies appear to have weakened. SGTI 2020 has found that the proportion of companies disclosing their key risks and associated risk management strategies has been gradually declining over the past two years (Figure 4). Furthermore, the proportion of companies that disclose their risk tolerance policy or the link between risk management and remuneration remain relatively low, hovering at the 5 to 10-percent mark.

While low rates of disclosure do not necessarily imply deficiencies in risk management, it does put into question the robustness of the risk management structures adopted by companies, particularly in times of crises. Therefore, more effort should be placed in enhancing disclosures in this area to increase companies’ overall resilience to events that adversely impact their businesses.

Sustainability Management

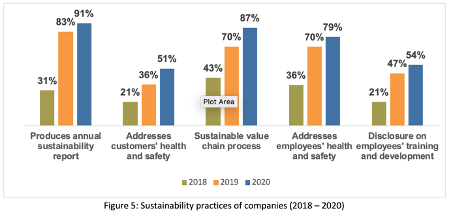

Another outstanding trend in SGTI 2020 is the apparent increase in emphasis placed on sustainability reporting. 91.0% of companies have released an annual sustainability report in SGTI 2020, compared to 83.3% the previous year. The rising quality of these sustainability reports has also been reflected in the remarkable performance for sustainability-related items, with significant improvements observed across the board (Figure 5).

Trust-Specific Performance

Moving on to REITs and business trusts, a similarly impressive improvement has been observed in SGTI 2020. This year saw a respectable 6.2-point increase in mean scores over the previous year (Figure 6) as these trusts continued their positive trend.

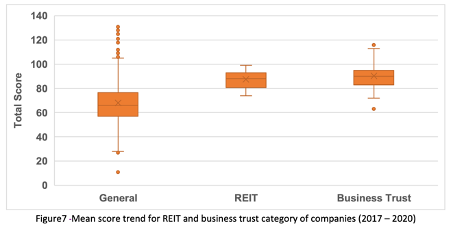

It was also observed that REITs and business trusts generally performed noticeably better than their counterparts in the general category over the years (Figure 7). This is possibly due to the more comprehensive disclosures that are required of REITs under the Code on Collective Investment Schemes.

Beyond Governance in Crises

As SGTI 2020 has shown, companies have ramped up on their corporate governance efforts. This has been reflected in the laudable improvements made over the previous years. Companies have put in more emphasis in their sustainability disclosures. However, there is also much room for improvement in addressing critical aspects in risk management.

Good corporate governance practices are essential for the survival and perpetuity of the company. However, is corporate governance the elixir for longevity? Perhaps good corporate governance is the means and not the end. It has to be coupled with sound business strategies, especially in pivoting to safety amidst the pandemic crisis.

How scoring for the Index is done

The Singapore Governance and Transparency Index (SGTI) is a joint initiative of CPA Australia, NUS Business School’s Centre for Governance, Institutions and Organisations (CGIO), and Singapore Institute of Directors. The strategic media partner is The Business Times.

The objective of the SGTI is to evaluate listed companies, including REITs and Business Trusts, on their corporate governance practices and disclosures, as well as the timeliness, accessibility and transparency of their financial results.

SGTI is a unified framework comprising two separate categories, namely the General Category and the REIT and Business Trust Category. These categories are distinct and are not to be compared directly with each other.

For the General Category, the SGTI score has two components: the base score and the adjustment for bonuses and penalties. The base score for companies contains five sections (“BREAD”): (1) board responsibilities [35 points]; (2) rights of shareholders [20 points]; (3) engagement of stakeholders [10 points]; (4) accountability and audit [10 points]; and (5) disclosure and transparency [25 points]. The aggregate of bonuses and penalties is incorporated to the base score to arrive at the company’s SGTI total score.

For the REIT and Business Trust Category, the companies are evaluated on a similar set of criteria, but with added coverage on the unique nature of their operations. The base score for REITs and Business Trusts includes: items in the base score for the SGTI (converted to 75 points) as well as trust-specific items for REITs and Business Trusts (25 points) which covers five aspects (“SLICE”): (1) structure; (2) leverage; (3) interested person transactions; (4) competency of REIT manager / trustee-manager; and (5) emoluments.

SGTI 2020 covers 577 Singapore-listed companies in the General Category as well as 45 REITs and Business Trusts which released their annual reports by 30 Jun 2020. The sources of information for SGTI assessment include annual reports, websites, announcements on SGXNet, and investor relations’ email responsiveness. Announcements made on SGXNet as well as in media coverage, which occurred between 1 January 2018 and 31 May 2020, have been used to update the scores.

Further information on the scoring methodology, including the full instrument, and past results may be obtained from CGIO’s website at https://bschool.nus.edu.sg/CGIO. Queries about the SGTI may be sent to cgio@nus.edu.sg. In order to maintain independence and fairness of the SGTI, reports or advice cannot be provided to individual companies.