In the October 2020 issue of Asia Asset Management, we argued against writing off bonds just because yields are in low territory. This is due to bonds having a multi-functional role in capital markets; in the provision of liquidity, preservation of capital, and, indeed, in the supply of income, at least in the case of higher-yielding corporate and convertible bonds.

In this article, we shall focus purely on convertible bonds.

Hybrid security

A convertible bond is a hybrid security. It looks like a plain-vanilla corporate bond, meaning it bears a maturity date, coupon payment, face value and credit risk. However, it also includes an option to convert into a predetermined number of shares of the common stock of the underlying company.

Consequently, a convertible security’s unique non-linear hybrid payoff structure is equivalent to a call option and a bond (or a put option and equity if appealing to put-call parity) – it provides a bond floor in bad times and equity participation in good.

Convertible bonds may provide a conservative way for investors to participate in the equity market in the current volatile environment, with market prognosticators predicting a “risk-on” situation from the expected early cycle economic recovery in 2021. The pundits nevertheless still have an eye on potential downside risks from global economic fragility stemming from unfinished trade wars, deglobalisation, deranged political leaders, and a prolonged coronavirus pandemic.

To the extent that the equity and credit markets have already priced in any slower growth and the uncertainties ahead, a rebound in the underlying equity and credit would both benefit convertible bonds.

On the other hand, in case the equity market weakens, the bond feature of the convertible will ease the downside risk. Should the credit deteriorate further and the company goes into bankruptcy, convertible holders would have a senior claim before equity shareholders.

Current valuation

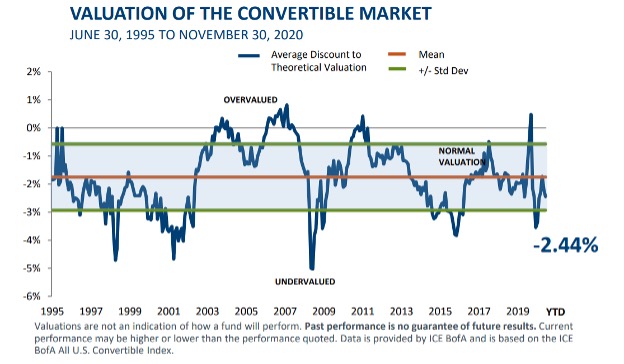

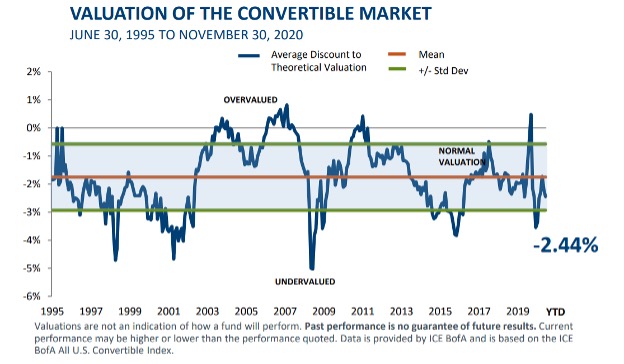

In addition, many convertible bonds are trading below their theoretical fair value, i.e., they are cheap based on valuation. According to Calamos Investments (figure 1), the ICE BofA All US Convertible Index was trading at an average discount of minus 2.44% to theoretical value in November 2020.

Figure 1: Valuation of the convertible market (June 30, 1995 – November 30, 2020).

Source: Calamos Investments

This phenomenon is not unique to US convertible bonds. Chinese computer maker Lenovo, which issued US$675 million of five-year convertible bonds with a 3.75% coupon on January 24, 2019, is also seeing the debt trade cheap currently. According to Refinitiv, it was quoted at a minus 3.97% discount to fair value in late December 2020.

Benefits

In summary, all things being equal and cheapness aside, investing in convertibles balances investors’ need to protect their capital and receive periodic coupons, while not foregoing the potential equity upside. All this is accomplished via a single hybrid security, which would normally take a portfolio of the underlying equity and derivatives to achieve the same effect.

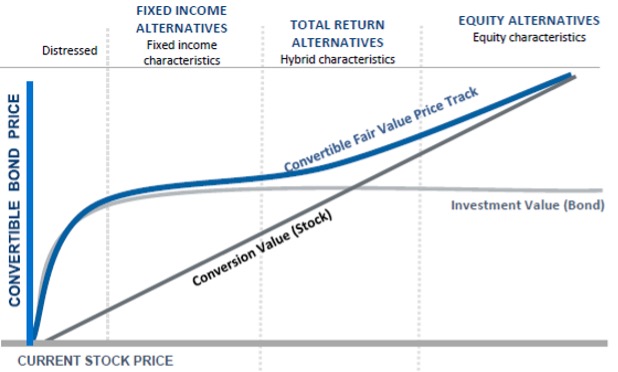

Unlike a straight equity or bond, the trading character of convertible bonds is different in an up versus down market. And it changes dynamically to the advantage of investors. When the market is advancing, the bonds become like equity, because the option to convert becomes increasingly in the money. When the market is declining, it behaves like a bond, because the face value is promised to be returned to investors at maturity.

This hedging-like feature allows investors to obtain greater downside protection while maintaining the upside potential. Over time, the asymmetric up/down market behaviour leads to returns like those of stocks but with a lower volatility. Thus, it is common to see mutual funds, insurance firms and retirement funds among the long-only investors in convertibles.

Furthermore, while convertible bond returns have lower volatility, the volatility of the underlying equity of the company translates to a welcome positive. This is because the option to convert is increasingly valuable as the underlying volatility increases. Indeed, this is partly why convertibles are usually issued by startups, technology firms, venture funds and other firms that have highly volatile payoff structures.

On the issuer side, before Amazon became the powerhouse it is today, capital infusion through two convertible bond offerings in 1999 and 2000 helped it weather the dot-com crash of 2000, which wiped out more than 90% of its stock price in a two-year period. Amazon was able to raise capital at a coupon rate lower than its straight debt, while convertible investors received 4.75% and 6.90% in coupon payments versus stockholders who received zero dividends until the stock price recovered.

As mentioned, convertible investors have seniority over equity holders in the event of bankruptcy; it ranks higher than stocks in the capital structure pecking order of the firm.

Complexity

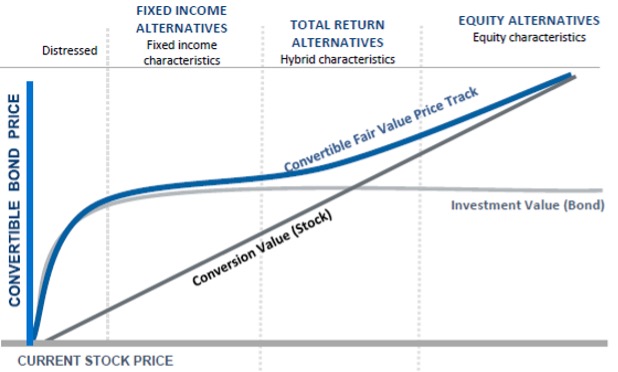

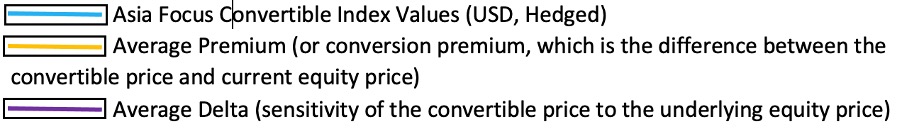

But buyer beware. Due to their hybrid nature, the relative value of convertibles as well as the trading behaviour is highly complex and contingent upon many moving parts, such as the underlying equity price, credit spread, interest rates, volatility, and the “Greeks”, like delta, gamma, theta (time decay), etc. Figures 2a and 2b depict the complex nature of convertible bond valuation and evolution at both individual security and index levels.

For yield-seeking investors, convertibles typically have lower income streams than the corresponding bonds, as in the case of Amazon. In addition, the advantage of downside protection with upside potential comes with a cost, called conversion premium, which is the amount by which the price of a convertible security exceeds the current market value of the common stock into which it may be converted at a point in time. They may also have embedded features such as being callable, i.e., the issuing company may “call back” the security, thus limiting the upside when you most need it.

However, converting the securities can be highly dilutive to existing shareholders if it does not have any anti-dilution provisions or clauses.

Figure 2a: Convertible bond valuation. Source: Calamos Investments

Figure 2b: Refinitiv Convertible Index - Asia Focus (USD, Hedged)

Sample period: 7 Jan 2011 – 1 Jan 2021 (Weekly). Source: Refinitiv

Finally, convertibles may not be accessible to some investors due to its minimum investment size, liquidity and credit rating, among other things. That said, there are funds and exchange-traded funds that provide such investors access to a diversified set of convertible bonds.

Asia markets

At the macro level, Asia’s relative economic strength provides many growth opportunities. We have already seen the flow of funds shift weight from the West to East as this region’s growth continues. Increasingly larger issues of convertible bonds are coming from Asia, such as China’s Daqin Railway, which sold $4.89 billion of six-year convertibles with a 0.2% coupon on December 10. As Asia accounts for an increasingly larger share of new securities issuance globally, convertible issuance will also rise.

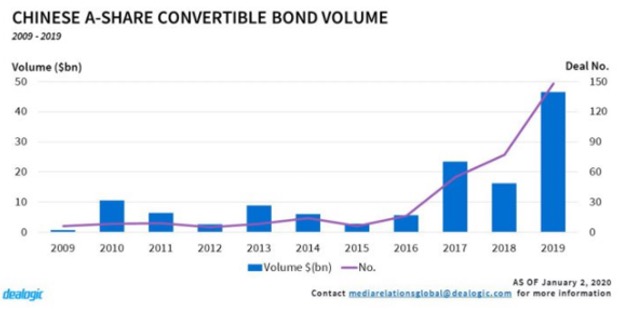

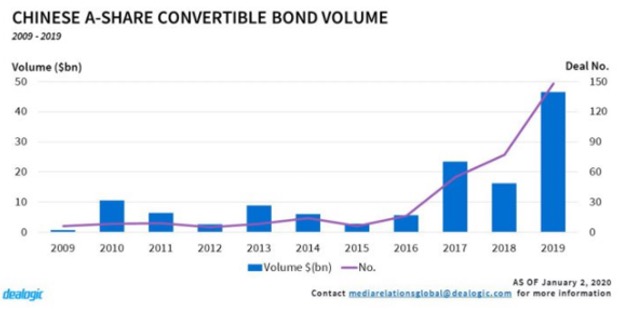

Asia’s bond markets are still in their infancy in many markets, including China. Yet, China is the second largest bond market in the world after the US. According to Dealogic, China had a record $46.5 billion of convertibles in 148 issuances in 2019 (figure 3).

Figure 3: Deal volumes in the Chinese A-Share Convertible Bond Market (2009 – 2019).

Source: Dealogic

The World Bank ranks Malaysia third in Asia in terms of bond market development. The combined size of Malaysia’s sukuk or Islamic bond and conventional bond markets is approximately 98% of the country’s gross domestic product[1].

In general, the development of the traditional bond market in Asia will be crucial for the development of its convertible bond market.

Hedge community

The convertible “hedge” community was a significant part of the market before the coronavirus crisis. They typically long convertibles and short the underlying stock or credit, to take advantage of cheap borrowing costs, cheap volatility (implying lower valuation), or the income advantage over stocks.

As the cost of borrowing and leveraging becomes unfavourable, the hedge communities may become less active. Long-only investors focus more on the underlying company’s health and growth thesis. As the underlying stock and credit become cheaper and long-only positions become more profitable, we should see the investor base tilt towards the long-only or “outright” investors.

Over time, we expect both the hedge community and the outright community to be active participants of the global convertible bond market, including in Asia.

[1] World Bank. 2020. Malaysia’s Domestic Bond Market: A Success Story. World Bank, Washington, DC. URL: https://openknowledge.worldbank.org/handle/10986/34538

The article was written with Emma Yan, an adviser at Endowus (Singapore), independent director at China Asset Management (Hong Kong) Limited, and a former senior portfolio manager at Columbia Management Group in New York where she was responsible for portfolio management and trading of all convertible securities accounts.

The article first appeared in the February 2021 issue of Asia Asset Management.