Consumer prices in the United States have risen by 6.8 per cent annualised in November 2021, the biggest one-year jump seen in 30 years. Should Singaporean investors care? Probably not that much. And if they do, it’s only to the extent that it will affect their nominal investment returns based in US dollars and their USD currency gains or losses. Let’s see why.

Firstly, most people invest their home currency not just to get more currency in the future, but in hope that the returns can help them buy more goods and services in the future.

Suppose you invest in the S&P 500 Index, which features 500 top US listed companies. You convert Singapore dollar (SGD) to USD, and then invest in the S&P 500, then when you receive the gains in USD, you convert them back into SGD in the future. Notice that the only risk exposures you face when conducting such an investment is the S&P 500 return in USD as well as the appreciation or depreciation of the USD with respect to SGD.

If the USD appreciates, your total SGD return from investing in the S&P 500 will be higher than the reported S&P 500 return in USD (which is the default reporting currency). Conversely, if the SGD appreciates, your returns in SGD will be less than the reported S&P 500 returns.

This framework allows us to consider separately the S&P 500 returns which is reported in USD, and the USD appreciation or depreciation with respect to SGD. Note that nowhere in this formulation does inflation directly come into play. This means that the inflation in the United States only affects your returns to the extent that it affects the reported S&P 500 return or the USD exchange rate return.

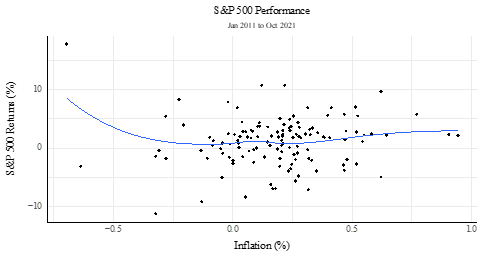

In theory, inflation could indirectly affect your SGD returns through the S&P 500 USD returns itself. Indeed, research in the 1970s to 1990s has shown that higher inflation correlates with slightly lower equity returns in the United States. However, in the past decade, that relationship has become statistically insignificant, and even turned slightly positive in the past five years.

Inflation for all items from St Louis Fed and S&P 500 data from Yahoo Finance. Author's calculations.

But people also worry about whether inflation may induce the US Federal Reserve to stop quantitative easing, and even the slowdown of asset purchases (let alone the sale of purchase to raise the interest rate) would tend to decrease equity market returns.

Inflation could affect the USD relative to other currencies. However, overwhelming academic research suggests that when interest rates rise for a currency, it tends to appreciate. In this case, if the US Federal Reserve raises the interest rates, perhaps the USD will appreciate as well.

So, what can investors do? When the only certainty is uncertainty, diversification is a sensible defensive stance, as it reduces the impact of shock.

For example, investors can diversify their assets globally, thereby slightly reducing the impact of changes in US economic conditions or policy.

They can also diversify across currencies, because if the US interest rates rise, other currencies may appreciate relative to the US, serving as additional buffer beyond the locally denominated stock returns themselves. Although a country’s inflation negatively correlates with its equity returns on average, comparing across countries, those with high inflation actually tend to have higher average returns.

Finally, the negative relation of inflation on overall equities actually obscures another investment opportunity: not all stocks are equally affected by changes in the interest rate. Industry research suggests stocks whose cashflows lie in the future, also known as growth stocks, tend to be slightly more sensitive to interest rates relative to firms whose cashflows largely occur now.

Therefore, investors may also consider altering their style exposures, tilting away from highly valued companies towards those with lower valuations and more current profitability. The latter kind of stocks tends to be less sensitive to economic conditions and serve as a defence as they are backed by a cushion of cash-generating business activities based on sound business practices and cashflow generation ability.

So if we are worried about US inflation, we should maintain a diversified portfolio of global stocks and allocate to different types of stocks. But beyond that, rather than being concerned about whether Americans have deteriorated purchasing power in the future, we should probably focus on what’s happening here at home. After all, although US inflation does not directly affect our portfolio returns, local inflation does. Higher prices at home will deteriorate our purchasing power no matter what our investment return is.