SATS is top scorer in top 100 Singapore companies

Singapore publicly-listed companies have improved significantly in corporate governance. In the latest ASEAN Corporate Governance Scorecard (ACGS), Singapore companies scored 88.3 out of 130 points on average, the highest score to date.

SATS, the chief ground-handling and in-flight catering service provider at Changi Airport, is the top scorer with 119.7 points under the top 100 Singapore companies.

The biennial ACGS is part of an initiative under the ASEAN Capital Markets Forum, a high-level grouping of capital market regulators. The Monetary Authority of Singapore (MAS) had appointed the National University of Singapore (NUS) Business School’s Centre for Governance, Institutions and Organisations (CGIO) and Singapore Institute of Directors (SID) as Singapore’s domestic ranking body for the ASEAN Corporate Governance Initiative since 2013.

Singapore, Indonesia, Malaysia, Thailand, the Philippines and Vietnam participated in the latest assessment which began in 2019. The domestic ranking bodies each assessed a list of top 100 publicly-listed companies by market capitalisation in their jurisdictions. The top 35 companies from each country underwent peer review assessment randomly by the domestic ranking bodies of the other countries. The final scores of these companies were derived after discussion by the ranking bodies. This produced a list of companies in ASEAN that had achieved a minimum score of 75 per cent out of 130 points, a list of the top 20 companies in ASEAN, and a list of the top three companies in each country.

Singapore companies put in a strong showing. More than a quarter (26 companies) scored at least 75 per cent of the total attainable 130 points.

Top 10 Singapore scorers

The top 100 Singapore companies assessed had a combined market capitalisation of S$484 billion, which accounted for almost half of SGX’s total market capitalisation as of 31 March 2019. Among these companies, SATS leapfrogged to the first position from its 11th position in the last assessment, while United Overseas Bank and Singapore Exchange improved to second and third positions from their previously held fifth and fourth positions. The remaining top 10 scorers are Singapore Telecommunications, Oversea-Chinese Banking Corporation Ltd, Singapore Press Holdings, DBS Holdings, ComfortDelGro Corporation, Keppel Corporation and Sembcorp Industries, in that order.

The top five companies were also among the Top 20 ASEAN Publicly-Listed Companies.

Mr John Lim, Chairman of the Corporate Governance Benchmarks Committee, SID, said: “It is most encouraging to note the significant improvement in average scores for Singapore’s top 100 companies in the latest assessment and we commend them on this achievement. However, our companies should be able to do even better with greater disclosures of their corporate governance practices. Good disclosure is one area where we appear to have lagged some of our ASEAN colleagues in recent years.”

Associate Professor Lawrence Loh, Director of CGIO, NUS Business School, said: “As a member of the ASEAN market, it is important for Singapore to push the corporate governance standards of ASEAN as a bloc, so as to increase the attractiveness of ASEAN to global investors.”

Methodology

The ACGS was developed by a group of regional corporate governance experts from the domestic ranking bodies, with seed funding from the Asian Development Bank. It is a tool for ASEAN companies to improve their corporate governance practices and increase their visibility and investment attractiveness to global investors. The ACGS can also be used by regulators as a reference for reviewing rules and guidelines in order to enhance corporate governance practices.

The ACGS scores comprise two sections — Level 1 and Level 2 scores. The Level 1 score consists of five components: rights of shareholders; equitable treatment of shareholders; role of shareholders; disclosure and transparency; and responsibilities of the board. The Level 2 score is made up of bonus and penalty points.

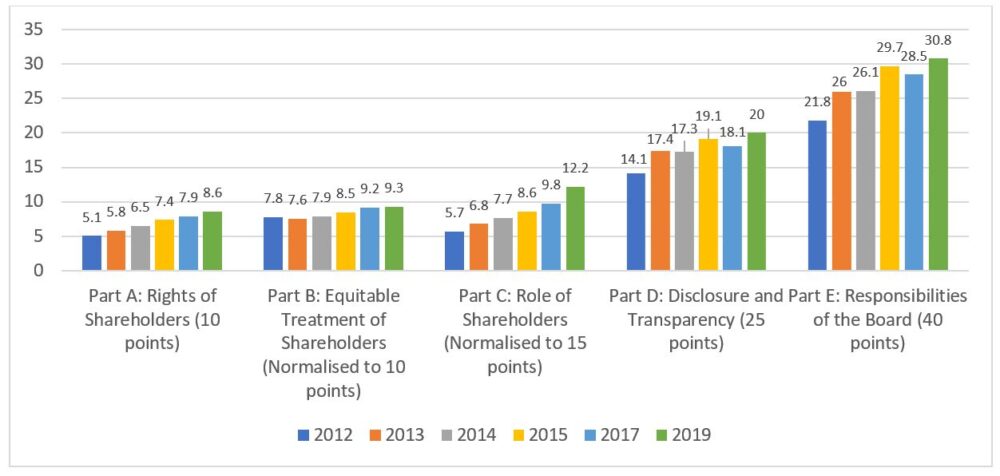

Singapore publicly-listed companies improved across all sections over the years (see Figure 1). The greatest improvement was seen in the score for the role of shareholders. It increased by 114 per cent to 12.2 points in 2019 (the year it was assessed) from 5.7 points in 2012. The component on equitable treatment of shareholders had the smallest rise in the scores, registering a 19 per cent increase to 9.3 points from 7.8 points over the same period. The remaining three components also saw a significant rise – a 69 per cent rise in the score for rights of shareholders since 2012, a 42 per cent rise for disclosure and transparency and a 41 per cent rise for responsibilities of the board.

Please refer to the Annex for information on “ASEAN Corporate Governance Scorecard: Singapore Rankings” and “Normalised Level 1 scores for the period from 2012 to 2019”.

Click on the following link for the list of ACGS awardees: https://bit.ly/2LiP8yw

________________________________

For media enquiries, please contact:

ANG Hui Min

Manager, Corporate Communications

NUS Business School

National University of Singapore

Tel: +65 6601 5857

Email: huimin19@nus.edu.sg

YANG Wai Wai

Head, Communications and Research

Singapore Institute of Directors

Tel: +65 9797 9660

Email: waiwai.yang@sid.org.sg

About the Centre for Governance, Institutions and Organisations

The Centre for Governance, Institutions and Organisations (CGIO) was established by the National University of Singapore (NUS) Business School in 2010. It aims to spearhead relevant and high-impact research on governance and sustainability issues that are pertinent to Asia, including corporate governance, corporate sustainability, governance of family firms, state-linked companies, business groups, and institutions. CGIO also organises events such as public lectures, industry roundtables, and academic conferences on topics related to governance.

NUS Business School is known for providing management thought leadership from an Asian perspective, enabling its students and corporate partners to leverage global knowledge and Asian insights.

The School is one of the 17 Faculties and Schools at NUS. A leading global university centred in Asia, NUS is Singapore’s flagship university, which offers a global approach to education, research and entrepreneurship, with a focus on Asian perspectives and expertise. Its transformative education includes a broad-based curriculum underscored by multi-disciplinary courses and cross-faculty enrichment. More than 40,000 students from 100 countries enrich our vibrant and diverse campus community.

For more information, please visit bschool.nus.edu.sg, or go to the BIZBeat, which showcases the School’s research.

About Singapore Institute of Directors

The Singapore Institute of Directors (SID) is the national association of company directors. SID promotes the professional development of directors and corporate leaders, and provides thought leadership and benchmarking on corporate governance and directorship. It works closely with the authorities and its network of members and professionals, to uphold and enhance the highest standards of corporate governance and ethical conduct.

Formed in 1998, the membership of SID comprises mainly directors and senior leaders from business, government agencies and nonprofits. SID has a comprehensive training curriculum that covers the spectrum of a director’s developmental journey. Members have access to a range of resources, including research publications, forums, seminars, benchmarking awards and indices, board appointment services and regular networking and social events.

For more information, please visit www.sid.org.sg

Annex

ASEAN Corporate Governance Scorecard: Singapore Rankings*

| Latest Ranking* | Company Name | Award Category | 2017 Ranking** |

| 1 | SATS Ltd | @ # + | 11 |

| 2 | United Overseas Bank Ltd | @ # + | 5 |

| 3 | Singapore Exchange Ltd | @ # + | 4 |

| 4 | Singapore Telecommunications Ltd | # + | 1 |

| 5 | Oversea-Chinese Banking Corporation Ltd | # + | 8 |

| 6 | Singapore Press Holdings Ltd | + | 7 |

| 7 | DBS Group Holdings Ltd | + | 3 |

| 8 | ComfortDelGro Corporation Ltd | + | 18 |

| 9 | Keppel Corporation Ltd | + | – |

| 10 | Sembcorp Industries Ltd | + | 6 |

| 11 | Great Eastern Holdings Ltd | + | 9 |

| 12 | City Developments Ltd | + | 25 |

| 13 | Frasers Property Ltd | + | 20 |

| 14 | StarHub Ltd | + | 13 |

| 15 | Singapore Technologies Engineering Ltd | + | 14 |

| 16 | Olam International Ltd | + | 10 |

| 17 | Sembcorp Marine Ltd | + | 15 |

| 18 | CapitaLand Ltd | + | 2 |

| 19 | Far East Orchard Ltd | + | 68 |

| 20 | SIA Engineering Co Ltd | + | 19 |

| 21 | SBS Transit Ltd | + | 29 |

| 22 | Hong Leong Asia Limited | + | – |

| 23 | Perennial Real Estate Holdings Ltd | + | 21 |

| 24 | Singapore Post Ltd | + | 34 |

| 25 | Fraser and Neave Ltd | + | 28 |

| 26 | Singapore Airlines Ltd | + | 16 |

| 27 | GuocoLand Ltd | 50 | |

| 28 | Hong Leong Finance Ltd | 37 | |

| 29 | Genting Singapore Ltd | 72 | |

| 30 | Yoma Strategic Holdings Ltd | 26 | |

| 31 | Yeo Hiap Seng Ltd | 42 | |

| 32 | Wilmar International Ltd | 31 | |

| 33 | Venture Corporation Ltd | 38 | |

| 34 | Jardine Cycle & Carriage Ltd | 36 | |

| 35 | Thomson Medical Group Ltd | – | |

| 36 | Raffles Medical Group Ltd | 55 | |

| 37 | China Aviation Oil Singapore Corp Ltd | 24 | |

| 38 | Thai Beverage Pubic Co Ltd | 30 | |

| 39 | Hi-P International Ltd | 63 | |

| 40 | Vicom Ltd | 32 | |

| 41 | Ho Bee Land Ltd | 64 | |

| 42 | United Engineers Ltd | 39 | |

| 43 | Sheng Siong Group Ltd | 47 | |

| 44 | Haw Par Corp Ltd | 44 | |

| 45 | First Resources Ltd | 51 | |

| 46 | Silverlake Axis Ltd | 84 | |

| 47 | Health Management International Ltd | 65 | |

| 48 | Bukit Sembawang Estates Ltd | 66 | |

| 49 | Roxy-Pacific Holdings Ltd | 49 | |

| 50 | United Industrial Corp Ltd | 43 | |

| 51 | Tuan Sing Holdings Ltd | – | |

| 52 | Delfi Ltd | 60 | |

| 53 | Wing Tai Holdings Ltd | 91 | |

| 54 | Centurion Corporation Ltd | – | |

| 55 | QAF Ltd | 48 | |

| 56 | Talkmed Group Ltd | 52 | |

| 57 | Halcyon Agri Corp Ltd | 53 | |

| 58 | UOL Group Ltd | 33 | |

| 59 | United Overseas Insurance Ltd | – | |

| 60 | Breadtalk Group Ltd | – | |

| 61 | Tianjin Zhong Xin Pharm Group | – | |

| 62 | Japfa Ltd | 62 | |

| 63 | First Sponsor Group Ltd | 92 | |

| 64 | OUE Ltd | 41 | |

| 65 | GL Ltd | 76 | |

| 66 | Q & M Dental Group (S) Ltd | 67 | |

| 67 | Yangzijiang Shipbuilding Holdings Ltd | 45 | |

| 68 | China Sunsine Chemical Holdings Ltd | – | |

| 69 | Hong Fok Corporation Ltd | 82 | |

| 70 | Hiap Hoe Ltd | – | |

| 71 | Yanlord Land Group Ltd | 57 | |

| 72 | SIIC Environment Holdings Ltd | 89 | |

| 73 | Banyan Tree Holdings Ltd | – | |

| 74 | GSH Corporation Ltd | 83 | |

| 75 | Golden Agri-Resources Ltd | 35 | |

| 76 | Singhaiyi Group Ltd | – | |

| 77 | Gallant Venture Ltd | 93 | |

| 78 | Oxley Holdings Ltd | 87 | |

| 79 | MEWAH INTERNATIONAL INC | 61 | |

| 80 | Sinarmas Land Ltd | 79 | |

| 81 | Chip Eng Seng Corp Corporation Ltd | – | |

| 82 | China Everbright Water Ltd | 70 | |

| 83 | Stamford Land Corporation Ltd | – | |

| 84 | China Jinjiang Environment Holding Co Ltd | 88 | |

| 85 | Bumitama Agri Ltd | 54 | |

| 86 | NSL Ltd | 86 | |

| 87 | Elec & Eltek International Co Ltd | – | |

| 88 | UMS Holdings Ltd | – | |

| 89 | CITIC Envirotech Ltd | 58 | |

| 90 | Golden Energy & Resources Ltd | 73 | |

| 91 | Hotel Properties Ltd | 95 | |

| 92 | Sunpower Group Ltd | 97 | |

| 93 | Ying Li International Real Estate Ltd | – | |

| 94 | COSCO Shipping International Ltd | – | |

| 95 | UnUsUal Ltd | – | |

| 96 | Bonvests Holdings Ltd | 80 | |

| 97 | Riverstone Holdings Ltd | 71 | |

| 98 | Straco Corporation Ltd | 96 | |

| 99 | Straits Trading Co Ltd | 59 | |

| 100 | Aspial Corporation Ltd | 98 |

* Only the 100 largest companies by market capitalization are ranked.

** 2018 was a gap year and no assessment was conducted.

@ denotes Top 3 Singapore PLCs

# denotes Top 20 ASEAN PLCs

+ denotes ASEAN Asset Class. ASEAN Asset class refers to the class of companies in ASEAN that achieved a minimum score of 97.5 points (75% of the total 130 points achievable) in ASEAN Corporate Governance Scorecard in 2019.

___________________________________________________________________________________

Source: Singapore Institute of Directors and Centre for Governance, Institutions and Organisations, NUS Business School