NUS BBA alumna Sylvia Lim (Class of 1993) is the Executive Director of UBS, advising private clients in wealth management. Looking back at her days in NUS Business School, she remembers fondly lecturers like Prof Annie Koh (who has left NUS) who taught her investment analysis, as well as her friends whom she is still in touch. She has served briefly in Bizad Alumni about 10 years ago, stopping when she pursued her Master of Science in Wealth Management degree.

Outside-In speaks to Sylvia, who maintains her passion for business all these years, and is eager to share her experience and mentor students.

NUS BBA alumna Sylvia Lim is the Executive Director of UBS.

Q: What was life like in NUS Business School for you?

I think of my alma mater very fondly even until today. It was a place where I not only received a good academic foundation over four years (more if you consider my NUS Master of Arts in Southeast Asian Studies), I also build a network of very firm lifelong friends.

I remember spending a lot of time in the libraries. We did not have a lot of computer resources then. Teaching and learning were done conventionally and there were no online resources or Google. One often had to go to the library to do research or follow up on the references given by the lecturer and tutors. So we met up with fellow friends in libraries and canteens and that was often how relationships were formed as we exchanged notes, ideas and tips.

Apart from school work, we also spent a lot of time on fun and meaningful activities. I was pretty active in the BizAd Society, helping to organise activities for fellow undergraduates. I also participated in larger scale events at the NUS Students’ Union, serving in the organising committee for the annual Rag and Flag Day. We had the honour of hosting the late President Wee Kim Wee who graced the occasion. I recalled we took quite a number of photos with him, but in an age where there were no Facebook and Instagram, I never know where those photos landed.

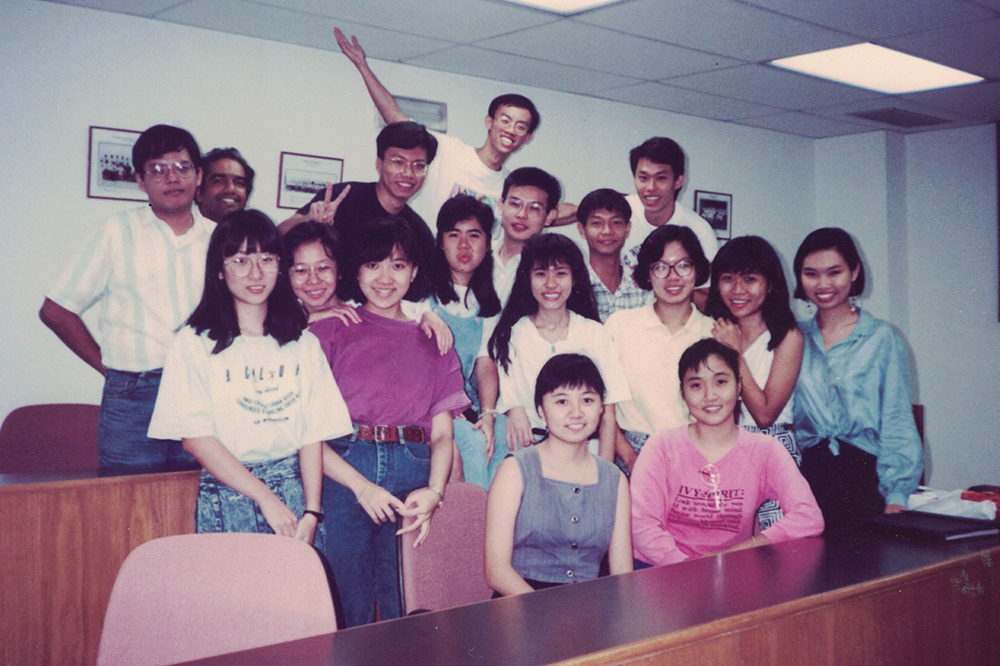

Sylvia still keeps in touch with her friends from NUS Business School.

Q: It seems like finance is something close to your heart. Why did you decide to major in finance?

With captivating lecturers like Assoc Prof Ang Swee Hoon, I was in fact more interested in marketing subjects. Though it has been more than 20 years since I left school, I can still remember what the lecturers taught and what we did for our projects. I majored in Finance eventually because I often did well in those subjects. It was also because I have the belief that no businesses can thrive without proper financial management. So I wanted to learn essential finance that would serve as the bedrock to my business education.

Q: How has the finance industry changed since you graduated?

The level of sophistication has increased tremendously. This manifests in the way we provide advice, as well as the types of investment products for high net worth clients and retail clients. The whole industry has become more dynamic and international. Even clients’ demands and needs have shifted given the exposure, technology advancements and how Asia has become the growth region. All these developments have helped to shape our financial landscape which continues to evolve at a fast pace. As we speak, the focus in recent months on digital banking licenses underlies the fact that the industry is continually being disrupted. This would be an exciting decade to witness new transitions.

At UBS, Sylvia (second from left) served in a regional volunteer programme to help children and youths in Dharavi, India.

Q: What advice would you give to your juniors who are looking to venture into finance?

The finance space is very exciting and dynamic, and constant learning is key. One should also learn to be adaptable. Resilience and hard work are a must. Try not to take shortcuts even when the short term goals may seem to be more pressing. Integrity, doing things right, creating value through building one’s expertise and staying relevant would ensure a more sustainable career.

Q: Financial crises can happen. What advice would you give to young Bizaders when they run into future financial crises or other negative events?

My advice would be to stay calm and do your best for your clients. A global financial crisis would be a time of fear and panic in the markets. It is a time where bankers can exercise discretion through experience, compassion, and make certain decisions that are beyond the capabilities of robo-advisers. The ability to assuage clients’ fears and the ability to help them assess information for decision-making would be important. This is akin to a doctor helping a patient who is in critical condition. You may not be able to control or guarantee the outcomes, but you can lighten the burden and make an impact in the process.