The university-wide SGFIN-Fidelity Sustainable Finance Case Competition 2023 brought together more than 150 participants in NUS, with teams from NUS Business School clinching the top three spots.

By Vigilia Ang and Zhang Weina

How should small-and-medium enterprises (SMEs) in Singapore transition to a more sustainable pathway? That was the challenge for 40 NUS student teams in the inaugural SGFIN-Fidelity Sustainable Finance Case Competition 2023.

The three-month-long competition culminated in three winning teams who proposed the best financially viable solutions for an SME’s solar energy adoption, allowing for a transition pathway towards sustainability. The initial case problem was provided by SGFIN’s industry partner RHT Green. With Singapore’s efforts to double solar energy capacity to 2 gigawatt-peak (GWp) by 2030, their proposals offer useful considerations for SMEs in their renewable energy transition.

Let’s take a look at the winning teams.

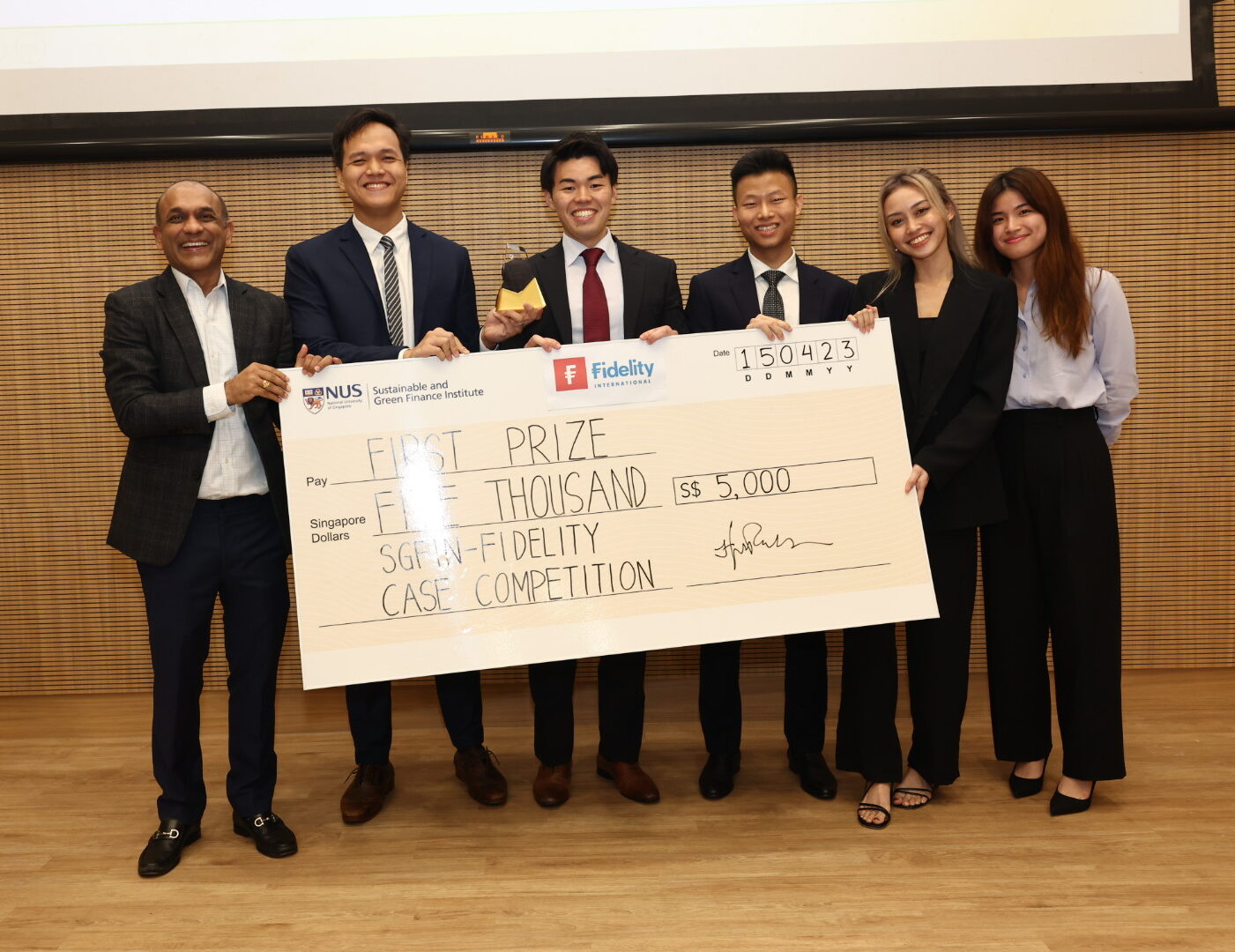

The first prize goes to Team Rainforest Consulting, consisting of business undergrads Phyo Thet Khine, Kohki Higashitani, Herbert Lim Jing Kang and Gwyneth Lee Shi Xuan (2nd to 5th from left). Low Tuck Kwong Distinguished Professor of Finance Sumit Agarwal (1st from left), who is also Managing Director of SGFIN, and Ms Kess Leung (far right), representative of Fidelity International, presented the prize. The team’s novel idea of the SME adopting a Power Purchase Agreement (PPA) from a partner and buying the remaining electricity off the grid catered to the interests of various stakeholders. The practicality of their business analytical skills impressed both the audience and the judges.

The second prize went to Team A2Z, consisting of NUS MSc in Finance students Qian Luyin, Li Mengxue, Wang Yiqian and Thet Naing Win (2nd to 5th position from left). The team took the initiative to interview SME owners to understand their needs and concerns for the energy transition. Most SMEs were willing to make the switch if administrative and financial barriers were reduced. One interesting point brought up by the team was that as these owners mostly rented their business premises, they could not make independent decisions regarding the energy transition.

Team JCube, consisting of NUS MSc in Sustainable and Green Finance students, won the third prize. (2nd to 5th position from left) He Xi, Zhao Jianxin, Liu Jiahuan, and Jefferson. They proposed the idea of building an ecosystem that allows for economies of scale to be reaped by a coordinated SME sector. This means that aspects such as financing, installing, measuring, monitoring and reporting could be achieved with lower costs.

The other finalist teams shortlisted by six judges include:

- Team Halcyon Advisors: They suggested SMEs form a consortium to provide a one-stop solution. The consortium could provide subsidised loans and coordinate the cross-sharing of rooftop spaces.

- Team Green Consulting: They utilised the concept of levelized cost of energy (LCOE) in their financial analysis and demonstrated the feasibility of their generalised decision framework for the SMEs present in a particular precinct.

- Team Green GPT: They presented a detailed quantitative analysis that included carbon tax considerations. The team also considered two simulation tools to link the photovoltaic (PV) performance of solar panels in different locations and periods in Singapore.

- Team NUSC-12-107: They proposed an interesting decision matrix for SMEs to decide the optimal adoption model. The team also suggested SMEs consider both financial and social factors during their transition.

In conclusion, the SGFIN-Fidelity Sustainable Finance Case Competition 2023 was a meaningful journey for more than 150 participating students. We have also seen the emergence of talented and passionate young ones who want to put their expertise, time and effort into helping local companies embark on their sustainability journey. While the proposed solutions still have room for improvement, they allow local SMEs to take one step closer to sustainability.

More importantly, with the pressing need for sustainable solutions in our world today, it is vital that our younger generation develop the skills and knowledge needed to drive positive changes. We are excited to empower our students in shaping the future of sustainable finance in Singapore and beyond.

About the writers:

Vigilia Ang is the Research Associate at the Sustainable and Green Finance Institute (SGFIN) at NUS. Zhang Weina is the Associate Professor of Finance at NUS Business School, the Deputy Director of SGFIN, and the Academic Director of the NUS MSc in Sustainable and Green Finance Programme.