SingTel and CapitaLand Mall Trust have been ranked as best-governed and transparent listed companies in Singapore by the Centre for Governance, Institutions and Organisations’ (CGIO) Singapore Governance and Transparency Index (SGTI).

The results were announced by Centre Director, Associate Professor Lawrence Loh at a forum graced by guest of honour, Mr Tan Boon Gin, Chief Executive Officer, Singapore Exchange Regulation.

The SGTI assesses companies on their corporate governance disclosure and practices, as well as the timeliness, accessibility and transparency of their financial results announcements. It is published annually by CPA Australia, CGIO and Singapore Institute of Directors (SID).

For SingTel, it is the fifth consecutive year that it had won the General Category, and CapitaLand Commercial Trust overtook last year’s winner CapitaLand Mall Trust to clinch the REIT and Business Trust Category.

The results of the SGTI 2019 were announced at SGX Auditorium

This year’s index ranked a total of 578 Singapore-listed companies and 46 REITs and Business Trusts that released their annual reports by 31 May.

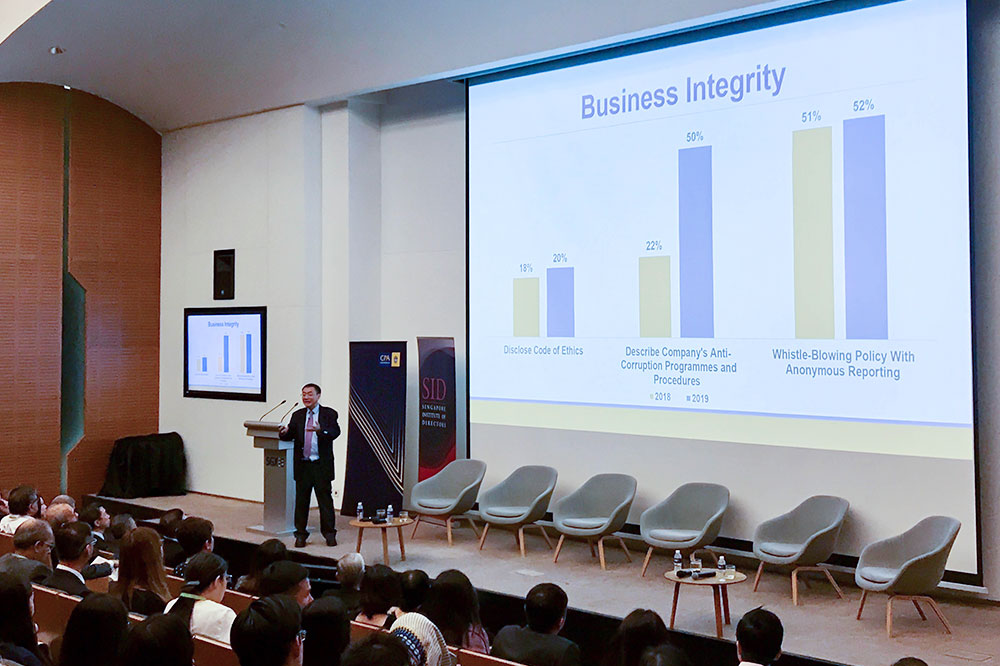

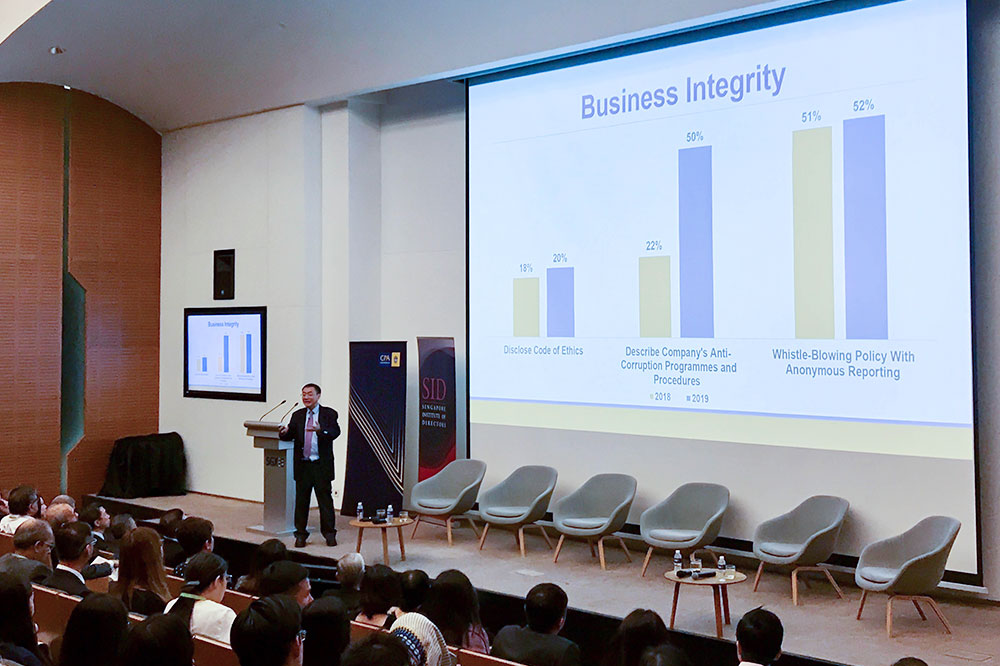

According to the Index, this year’s results show improvements in the following areas: Shareholders’ rights and audit standards continue to improve, as well as increased stakeholder engagement.

While overall development is noteworthy, there is still much room for growth. For instance, SGTI 2019 noted that there was no overall improvement in the disclosure and transparency category from the previous year.

Associate Professor Lawrence Loh, Director, CGIO, presented the key findings from SGTI 2019

Associate Professor Lawrence Loh, Director of CGIO, NUS Business School said, “SGTI 2019 serves as the baseline for the impending changes in the Code of Corporate Governance and listing rules. The results show that listed companies are well on track for the changes although there are specific aspects in board independence and business integrity that still require improvements. Good corporate governance is a continual journey and the Singapore corporate sector has been moving at a strong pace in the right direction.”

As part of the forum, Dean Andy Rose took part in a panel discussion about the evolution of corporate governance. It touched upon the trend of how companies were going beyond pragmatism to embrace governance and engage with stakeholders.

The panellists. From left: Melvin Yong of CPA Australia, Rachel Eng of Eng and Co, Leong Kok Ho of Tuan Sing Holdings, Goh Mui Hong of Global Investments, Prof Andrew Rose of NUS Business School, and June Sim of SGX RecCo.