A well-respected banker with over 30 years of private banking experience in global financial institutes such as American Express and UBS AG Wealth Management, Mr Bahren Shaari is currently the Chief Executive Officer (CEO) at Bank of Singapore. In February 2019, he was appointed by the Monetary Authority of Singapore to serve on the Corporate Governance Advisory Committee. In 2018, he was named the Berita Harian Achiever of the Year in recognition of his professional contributions and achievements to the community. Mr Bahren was one of the 12 outstanding alumni honoured at the NUS Business School Eminent Business Alumni Awards 2018.

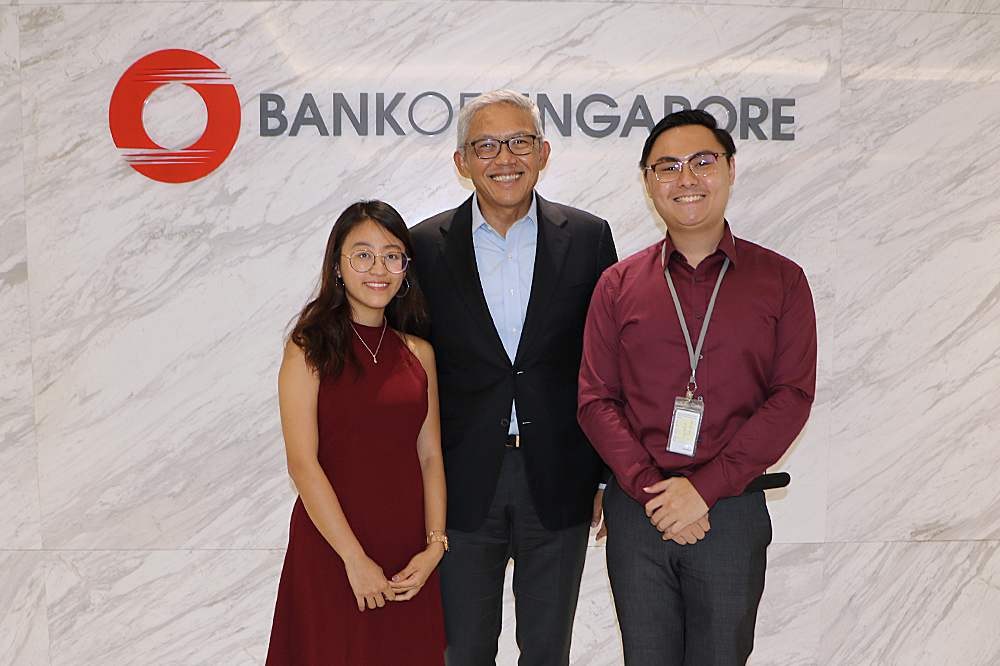

Alumni Spotlight Stories: Bahren Shaari, Bank of Singapore

Chief Executive Officer at Bank of Singapore

Bachelor of Business Administration – Accountancy (1984); with the NUS Business School Alumni (NUSBSA) team.

Q: Could you share more about your experience as CEO at Bank of Singapore and a short summary of a normal working day for you?

As a CEO, it is crucial to have a clear, strategic view of what you want in order to bring the bank forward. You must understand the external landscape, what is disrupting the banking industry, and how we are positioning ourselves. It is also about how we develop our people and to help them adapt to changes. A CEO has to make sure that the bank is allocating resources to the right places to move it forward.

Q:How did you accumulate work experiences or internships prior to your first formal job?

I did not have a lot of work experiences. In fact, I spent a lot of time with my friends from the Arts and Social Sciences Faculty. What I learnt from them was very different from what was taught in Business school. I watched them debate societal issues and this helped broaden my perspective, indirectly developing my interest in geopolitics. One important lesson I have learnt is that everyone should be adaptable to changes. We should be open to doing everything and not pigeonhole our skills into one area. It is important to find a good balance because doing a little bit of everything can run the risk of having no subject matter expertise.

My aspiration was very simple, I just wanted to be a good banker. My life motto: Do a good job and the rest will take care of itself. I did not have a career goal because I believed that being too fixated on a goal makes you less adaptable. A lot of things that happen at work is beyond your control. What you can control is doing a good job, having a good network and being good to others.

Q: When do you know it is the “right” moment to move?

I do not have an answer as to when exactly is the right moment to move. However, I do know that the wrong time to move is when you move for money-related reasons. When you do so, you can potentially destroy your own career. It is not sustainable. A person’s market worth is determined by the amount of knowledge and credibility gained at a particular place. Potential employers will know your market worth and, if you keep moving because of salary, it will not be good for your resume.

Everyone should be adaptable to changes

Q: What are some things you would have possibly done differently?

If I could turn back the clock, I would have spent more time networking. I was very focused on work and I could have missed out on some opportunities to cultivate more relationships.

One important thing I have learnt is that the big problems now will all become small problems in the future. Don’t sweat the small things. All the issues you are upset about right now will probably not bother you anymore when you are older and more mature.

When I look back now, I wonder why I was so upset over these small issues back then. Don’t squander time you don’t have but invest the time for the future.

Q: What are some of the trends you foresee happening in the private banking scene?

I do not foresee bankers being replaced by machines in the near future. Humans possess listening skills that machines are not able to replicate. In private banking, we must be able to connect with our wealthy clients to understand their needs and this can only be done effectively through listening.

In the next decade, robo-advisors will become a basic service. But it will not be able to differentiate one bank from another. To gain comparative advantage, the need to provide good client experience across all touchpoints will be further magnified.

Q: What are some pieces of advice you have for the people out there?

You must be self-motivated to learn, and you must want to learn. Learning is something that must be driven from within yourself. You can make options accessible to everyone, share the programmes, try to motivate and tell them why they must try something new. But you can never force them.

Furthermore, one should learn to reflect and switch off external noises. Today, there is too much peer influence on what you should be doing, but you should not be influenced by them. You must be clear about what you want to achieve. Anchor yourself in what you believe in and constantly re-evaluate, as circumstances may change.

The Alumni Spotlight Stories is a weekly series that explores a Bizad alumni’s journey from school to the working world. The story was first published in “Alumni Spotlight Stories: From Student Life to the Peak of your Career” compiled by the NUS Business School Alumni (NUSBSA).