Finance lecturer Dr Deserina Sulaeman loves the arts. Bringing her experience in non-profit and arts management to her impact investing class, she emphasises the need for arts organisations and other non-profits to show their impact to funders.

Q: You teach finance, and you like art. How do you see these two fields interacting?

In finance, we value assets and some people purchase art as an investment. However, the valuation of art differs from the valuation of firms. For firms, it is based on the expected future cash flows it will generate. Most artwork does not produce cash flows—their valuation is often based on the visual aesthetic and the future expected market demand for them.

Personally, I don’t buy artwork for investment. I buy artwork if I like it because I value its visual aesthetic as well as the stories behind it. Last year, I bought a few ceramics by local artist Ahmad Abu Bakar during an exhibition. While the pieces are beautiful, I think it’s also meaningful that the proceeds go towards supporting local artists too.

Dr Sulaeman bought ceramics made by local artist Ahmad Abu Bakar.

Q: You recently wrote an article about arts democratisation; what drew you to the arts?

I was always interested in the arts. I drew and painted when I was younger. My parents are architects, and I was exposed to their hand-drawn blueprints (before the time of computer-aided design).

I did not major in art in university, though; I studied computer engineering. But my love for the arts stayed, and I took drawing classes during my undergraduate days at Purdue University in the United States.

A special artwork on NUS Business School by Dr Sulaeman.

When I applied to an MBA programme in Dallas, Texas, the interviewer asked what I hoped to achieve with the degree. I said I hoped to open an art gallery one day and wanted to learn the business side of running the gallery. They suggested I take up their Master in Arts Administration along with the MBA instead, which was what happened.

Many examples I bring to my class on impact investing are related to the arts sector. In the US, the arts sector, especially the performing arts, is dominated by non-profit organisations, and they need to show their impact to investors.

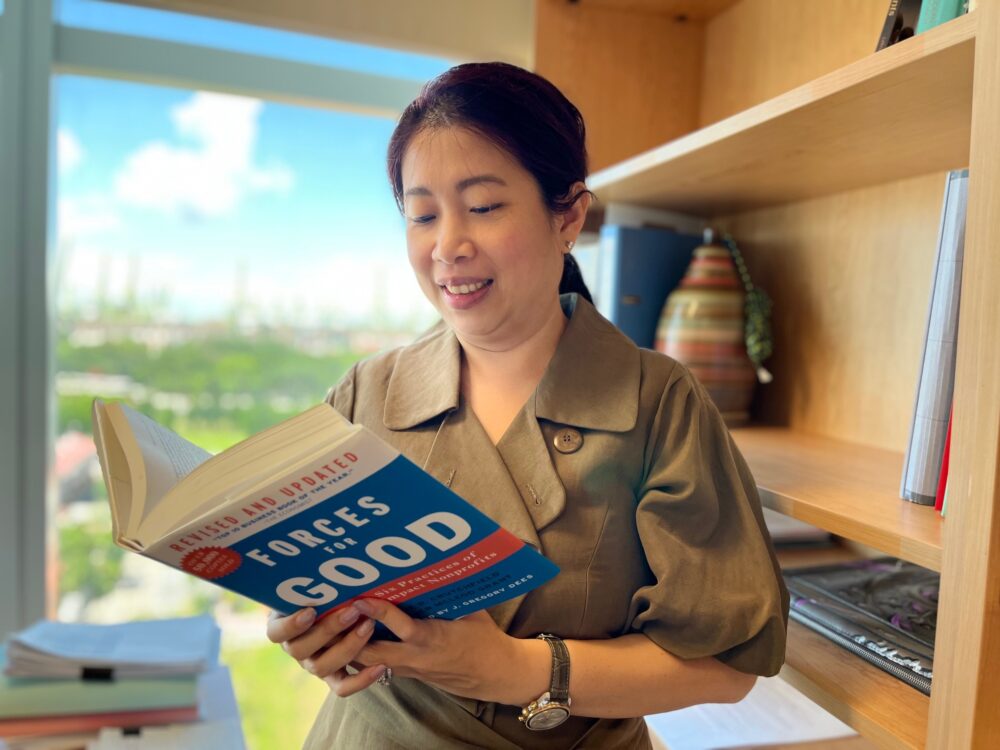

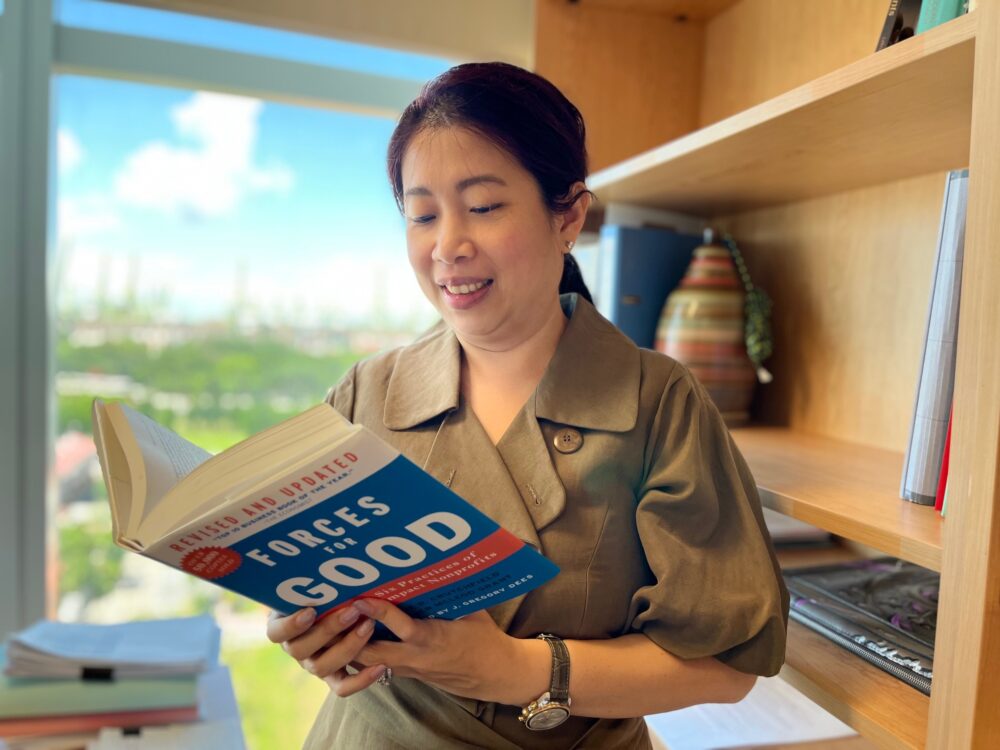

Dr Sulaeman says it is important for non-profit organisations to demonstrate their impact to funders.

Q: Could you share more about your work in arts management in the US?

I worked for non-profit arts organisations in numerous roles. For example, I was running programmes that helped fulfil the organisation’s mission; I did marketing for a museum; and for a long time, I worked as a data analyst analysing audience data from non-profits’ customer relationship management (CRM) systems. Many non-profit organisations have data but they don’t use it effectively.

Q: How do we increase arts organisations’ ability to use data?

Arts organisations usually have data, particularly if they sell tickets. The question is how organisations can use this data to improve their operation and show their impact. From their data, they can learn who their audience is, when they came, what they watched, and whether they are repeat customers.

It need not be the artists who interpret the data; this is where a businessperson with knowledge about the art sector can come in and help the organisations make sense of the data.

Sometimes, the impact can be better shown qualitatively instead of quantitatively. For example, exhibition organisers can do a short five-minute pre-event and post-event interview with visitors during an exhibition opening, asking them how the exhibition changed their views on a particular topic. This is a type of data that may require labour to collect. If they don’t have enough resources, they can deploy volunteers. I was often a volunteer for these events during my postgraduate days. Organisations can use these responses to show their impact to their stakeholders, and additionally, they can use this in their marketing to attract audiences.

Q: How can non-profits use data to achieve their goals?

Ideally, organisations start with their mission, which serves as a foundation for everything they do. They need to show funders the goals they actively pursue and then decide the type of metrics to evaluate their success and the data they need to collect. The problem with starting from data collection is that you may not be collecting the appropriate data to show the organisations’ impacts. It has to start from the goal, and then you work backwards.

Dr Sulaeman advises organisations to consider their mission before deciding what impact metrics to showcase.

One of the key challenges in impact measurement now is the lack of standardised metrics to measure impact. Funders and investors ask for different metrics, creating a heavy burden on the organisations. Some organisations may decide not to apply for funding in the end because the application process is too much work. But if the industry can develop a standardised impact evaluation format, it can reduce the non-profits’ administrative burden.

That will involve many stakeholders, but everyone can work towards this goal.