Barely a day after Prime Minister Lawrence Wong’s maiden National Day Rally, the government announced that it would tighten the maximum amount home buyers could borrow from the Housing and Development Board (HDB). The loan-to-value (LTV) limit for HDB loans was lowered from 80 per cent to 75 per cent with effect from Tuesday (Aug 20).

The Ministry of National Development and HDB also provided more updates on the Enhanced CPF Housing Grant (EHG) that Mr Wong had announced. The government raised the quantum of the EHG by up to S$40,000, with a higher distribution tilted toward the low- and medium-income families.

Will the new cooling measures bring down prices in Singapore’s red-hot HDB resale market?

More specifically, will this have an impact on the spurt of million-dollar flats of late? How will the new measures introduced also impact the private housing market?

Effects of tightening loan limits

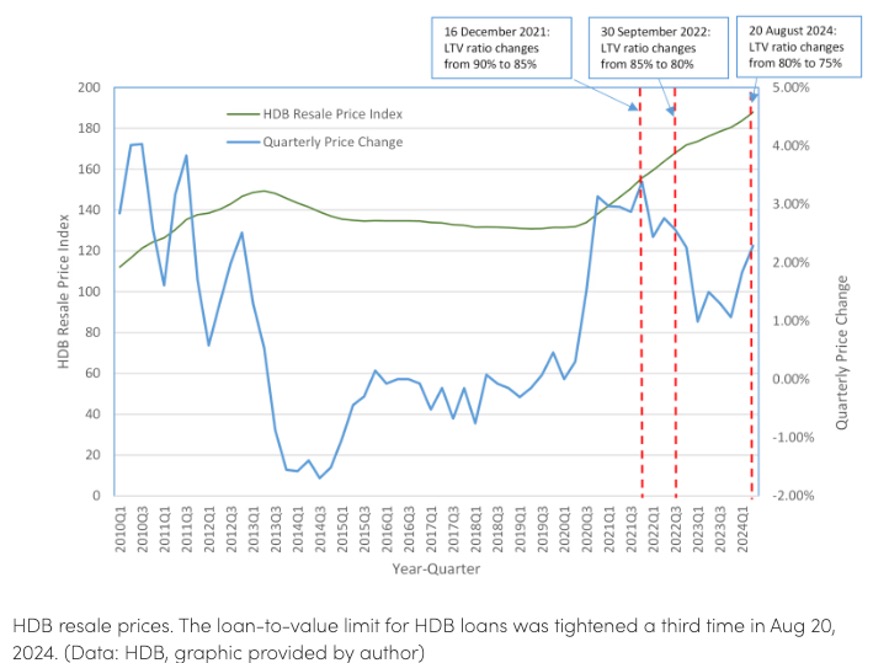

This latest measure is the third round of tightening the LTV limit for HDB loans. The previous two rounds in December 2021 and September 2022 saw the limit cut from 90 per cent to 85 per cent, then to 80 per cent.

The September 2022 cooling measures also included a requirement for private home owners to wait 15 months between selling private property and buying an HDB resale flat.

Still, home buyers have indeed been grappling with rising resale prices since 2020, with the HDB resale price index ticking upwards for 18 consecutive quarters. Prices have risen cumulatively by 43 per cent between the first quarter of 2020 and the second quarter of 2024.

The last two rounds of cooling measures did not dampen the overall upward price growth in the HDB resale market, but these two measures slowed down the growth rates in the resale markets. The cumulative yearly growth rates slowed down from 12.7 per cent in 2021 to 10.4 per cent in 2022 and subsequently to 4.9 per cent in 2023.

The prices could have gone out of control and caused excessive overheating in the market if the cooling measures had not been put in place.

Just this year, the resale prices rebounded strongly, with growth rates of 1.8 per cent and 2.3 per cent in the first and second quarters of 2024, respectively. The demand from buyers who were crowded out by high prices in the private housing markets and private downgraders who have waited out 15 months could have significantly bumped up the demand in the resale market.

Let’s not overly focus on million-dollar flats

The resale market is so much more than just million-dollar transactions.

Though the number of million-dollar transactions has been creeping up (369 in 2022, 469 in 2023 and 539 in the first seven months of 2024), they still account for only between 1.4 per cent and 3.2 per cent across transactions for the first seven months of 2024.

However, headlines about such transactions, coupled with noisy information in the market (such as incidents of misleading S$2 million listings), could cause undue anxiety and stir sentiment in buyers, who may have irrationally pushed up resale prices.

The latest cooling measure is not meant to stifle transaction activities, but it could instil prudence in buyers of high-priced resale flats. The 5 per cent reduction in LTV is small, but the cumulative 25 per cent upfront payment could moderate buyers’ irrational sentiment and exuberance.

For example, someone considering a S$1 million resale flat would now be required to make a higher initial down payment from S$200,000 to S$250,000. The monthly debt service of S$3,403, based on a loan term of 25 years and an interest rate of 2.6 per cent per annum for an HDB loan, may not deter the buyer with an income of S$11,342 (subject to the mortgage servicing ratio of 30 per cent).

However, they may have to rethink the purchase without enough cash on hand.

Calibrated financial support for lower- and middle- income

While the LTV rule is targeted at high-priced resale transactions, the EHG is mean-tested. Only those with an average monthly household income of less than S$9,000 receive it, with larger grants going to those with less means.

The lower- and middle-income families could receive up to S$120,000 in EHG when buying BTO flats directly from the HDB. They will receive a maximum grant of up to S$230,000, depending on their average monthly household income, when buying a resale flat of the two- to four-room type, which includes S$120,000 EHG, S$80,000 CPF Housing Grant (CHG), and S$30,000 Proximity Housing Grant if they live with their parents.

Unlike the last increase in CHG from S$50,000 to S$80,000 in February 2023, which applies uniformly to all first-time families when buying resale flats, the EHG grants are linked to the income of buyers. The lower and medium-income families benefit more from the EHG increases, which could help insulate them against the financial impact of the LTV rule change.

For a typical medium-income household earning S$5,000 per month and eyeing a BTO flat of S$500,0000, the down payment would increase by S$25,000 from S$100,000 to S$125,000 with the reduced LTV limit. However, it would receive S$65,000 under the new EHG, more than enough to offset the increase in down payment.

First-time low- and medium-income families are less likely to buy expensive flats in the resale markets, and thus, the spillover effect on the resale housing market is likely to be marginal. Instead, the higher EHG could provide more financial support for these financially constrained buyers, which could widen their choice of new BTO flats, including bigger Standard flats or even possibly “Plus” and “Prime” flats in choicer locations, once the new housing classification kicks in for the October 2024 BTO exercise.

The new measures introduced by the government are calibrated and targeted. On the one hand, the tighter LTV limit aimed to restrain high-income buyers from driving up prices in the high-price segment of the resale market. On the other hand, a higher EHG eases the financial burden and also lifts the affordability of low and medium-income families. It will also go a long way to make the housing market more inclusive by not letting financial constraints restrict access of low- and medium-income families to housing in the choicer locations.

The cooling measures are implemented to prevent irrational transactions that could cause overheating in the resale housing market. It may slow down price momentum to ensure a more sustainable price trend in the long term.

The “cooler” resale HDB market is not likely to cause price increases in the private housing market. Instead, the spillover, if any, is likely to be a negative one if public housing owners defer their upgrading decisions, which could further reduce transaction activities in the private housing market.

The story first appeared in CNA.